|

How Are Social Security Benefits Paid Out? Ida May is a striking example of the first generation of Social Security beneficiaries who were the big winners.

|

|

|

|

Social Security was to provide a means of income support for this unfortunate generation of the elderly.

Full Benefits Age (FBA) The age at which a Social Security recipient receives full retirement benefits (Primary Insurance Amount).

Early Entitlement Age (EEA)The earliest age at which a Social Security recipient can

receive reduced benefits. The very first beneficiary of Social Security was Ida May Fuller. da May worked for only three years after the establishment of the Social Security system, and paid a total of $24.75 in Social Security taxes. Ida May went on to live for 35 more years, dying at age 100 in 1975. Ove those 35 years, she collected a total of $22,888.92 in Social Security benefits. Quite a return on her $24.75 investment! Ida May is a striking example of the first generation of Social Security beneficiaries who were the big winners under this new social program.

1-e 2-b 3-a 4-a 5-b 6-a 7-b 8-e 9-e 10-e

3.1.Explain the Crowd -Out Problem in Education. How would this "solve" with the Educational Vouchers? How vouchers will lead to excessive school specialization or to Segregation?

Crowd-out problem: As the government provides more of a public good, the private sector will provide less.

Education is a public good that is provided to some extent by the private sector. As such, an important problem with the system of public education provision is that it may crowd out private education provision. Indeed, it is possible that providing a fixed amount of public education can actually lower educational attainment in society through inducing choice of lower quality public schools over higher-quality private schools

Vouchers might increase segregation by student skill level or motivation. As the motivated and high-skilled students flee poor-quality public schools for higher-quality private schools, the students left behind will

be in groups that are of lower motivation and skill. That is, school choice is likely to reduce segregation along some dimensions but increase it along others.

Vouchers might solve this crowd-out problem by allowing people to choose the optimal level of education for themselves, as well as interjecting competition into the education market.

At the same time, vouchers may lead to increased educational stratification, and the education market may face difficulties in implementing competition.

Existing evidence suggests that private school choice through vouchers can move students to better schools, but a much richer evaluation of the total social effects of vouchers is needed before policy conclusions can be drawn.

In Russia Spending on education will go down from 649.8 billion roubles to 618.9 billion roubles in 2015-2017

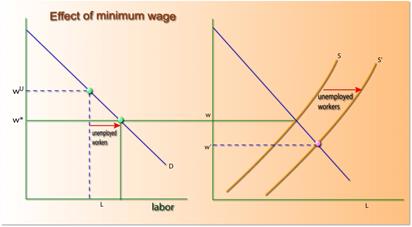

3.2 Suppose the federal government is considering raising the minimum wage to $10 per hour. An economist testifies to Congress that this plan is inefficient and causes deadweight loss.

|

a)Show graphically the deadweight loss caused by the minimum wage law.

|

|

|

b)Suppose that you are a member of Congress and you believe in the utilitarian social welfare function. How would you determine whether to vote for or against the policy?

The Rawlsian social welfare function is consistent with redistribution from the rich to the poor whenever utility is increasing in wealth (or income). The utilitarian social welfare function can also be consistent with a government that redistributes from the rich to the poor, for example, if utility depends only on wealth and exhibits diminishing marginal utility. However, the Rawlsian social welfare function weights the least-well-off more heavily, so it will generally prescribe more redistribution than the utilitarian social welfare function. If utility depends only on wealth and exhibits diminishing marginal utility, and if effi- ciency losses from redistribution are small, then both the utilitarian and Rawlsian social welfare functions can be consistent with government redistribution. A simple example can illustrate this point. Suppose that utility as a function of wealth is expressed as v = √w, and that a rich person has wealth of $100 (yielding utility of 10) and a poor person has wealth of $25 (yielding utility of 5). The sum of utilities is 10 + 5 = 15.

Tax the wealthy person $19; their remaining wealth is $81, yielding utility of 9. Give $12 of the $19 to the poor person; this yields wealth of 25 + 12 = $37. The square root (utility) of 37 is greater than 6, so total utility is now greater than 15, even with the effi- ciency loss of $7 ($19 – $12). Under the Rawlsian function, which considers only the least-well-off person’s utility, social welfare has increased from 5 to greater than 6.

c)Explain why this policy choice demonstrates a trade-off between equity and efficiency

Efficiency is not the only goal of government policy. Equity concerns induce govern- ment to intervene to help people living in poverty, even when there are efficiency losses. In economic terms, a society that willingly redistributes resources has determined that it is will- ing to pay for or give up some efficiency in exchange for the benefit of living in a society that cares for those who have fewer resources. Social welfare functions that reflect this willingness to pay for equity or preference for equity may be maximized when the government intervenes to redistribute resources.

d)Explain the Earned Income Tax Credit. Explain why the EITC may provide equity with small losses in efficiency.

The United States federal earned income tax credit or earned income credit (EITC or EIC) is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children.

The EITC increases wages for some, increasing their return to working and thus increas- ing the cost of leisure; not only do these workers earn a wage, but they receive a bonus, in the form of the EITC, on top of that wage. Because the EITC is available only as a subsidy for earned income, it specifically rewards work effort, thus tending to increase it for those who qualify for the benefit. Offsetting this effect is an income effect that tends to reduce work effort. The EITC programs increases the total income of any worker with positive earn- ings less than $33,700. This increase in income will tend to lead them to enjoy more leisure time—to reduce their labor supply. A similar effect is possible for workers who would earn slightly more than $33,700 in the absence of the EITC. These workers may choose to work slightly less when the EITC is put in place so that they can qualify for some EITC benefits and enjoy more leisure. An increase in the EITC compensation rate is likely to increase labor supply. In prin- ciple, there are offsetting substitution and income effects. The higher compensation rate makes leisure relatively more expensive for workers, so the substitution effect leads work- ers to supply more labor. Offsetting this, the higher compensation rate makes workers richer, leading them to consume more leisure and supply less labor. Since the EITC ap- plies only to low-income workers, however, the substitution effect is likely to dominate. In particular, some workers might not choose to work at all with the 30% compensation rate. They would face only the substitution effect, and it might be strong enough to induce some of them to enter the labor force. The low- income individual finds himself or herself in the phase-out portion of the EITC and is sub- jected to a high effective marginal tax rate.

|

|

|

VARIANT 18

|

|

|