|

Does asymmetric information necessarily lead to market failure?

|

|

|

|

VARIANT 1

Financial system of Russia and USA.

Current financial system of Russia and the USA

Financial system - form of organization of monetary relations between all the subjects of the reproduction process in distribution and redistribution of the GNP.

The financial system of the Russian Federation - a set of different spheres of financial relations, each of which is characterized by the features in the formation and use of funds of funds, a different role in social reproduction.

The financial system of the Russian Federation includes:

1. State budget system;

2. Off-budget special funds;

3. State and bank credit (all above mentioned institutions include a centralized finance, which are used to regulate the economy and social relations at the macro level);

4. Funds Insurance (property and personal);

5. Finance businesses and industries related to decentralized finance, which are used to regulate and stimulate the economy and social relations at the micro level.

The head of the financial system of the Russian Federation Ministry of Finance, which is the executive body ensuring implementation of a uniform financial, budgetary, fiscal and monetary policy and carrying out general management of the organization finance.

Central Bank is a government body and performs the state management in the field of banking.

US financial system constitutes:

´ the banking system (Federal Reserve System, commercial banks, foreign banks, offshore banks, saving institutions and credit unions).

´ nonbank financial institutions (asset-based finance companies, insurance companies and commercial lending companies).

´ financial markets (markets, debt and money markets and futures and options markets).

There are four main agencies in the US’ financial system:

FDIC - federal government agency that provides insurance protection for depositors at most commercial banks and mutual savings banks.

FED - central bank of the USA.

Office of the Comptroller of the Currency

The Office of the Comptroller of the Currency is a U.S. federal agency established by the National Currency Act of 1863 and serves to charter, regulate, and supervise all national banks and the federal branches and agencies of foreign banks in the United States.

Office of Thrift Supervision

The Office of Thrift Supervision is a United States federal agency under the Department of the Treasury.

From the legislative side the financial system of the USA is regulated by Federal parliament, also by parliaments of states.

Explain the Crowd -Out Problem in Education. How would this "solve" with the Educational Vouchers? How vouchers will lead to excessive school specialization or to Segregation?

Problem with the system of public education provision is that it may crowd out private education provision. Providing a fixed amount of public education can actually lower educational attainment in society through inducing choice of lower quality public schools over higher-quality private schools. One solution to the crowd -out problem would be the use of educational vouchers, whereby parents are given a credit of a certain value (for example, the average spending on a child of a given age in the public education system) that can be used toward the cost of tuition at any type of school, public or private. The first argument in favor of vouchers is that vouchers allow individuals to more closely match their educational choices with their tastes. The second argument in favor of vouchers is that they will allow the education market to benefit from the competitive pressures that make privatemarkets function efficiently. Supporters of vouchers note that, in fact, vouchers may serve to reduce the natural segregation that already exists in our educational system. Vouchers allow motivated students and their parents to choose a better education and end the segregation imposed on them by location. At the same time, vouchers might increase segregation by student skill level or motivation.

|

|

|

How Are Social Security Benefits Paid Out? Ida May is a striking example of the first generation of Social Security beneficiaries who were the big winners.

Social Security was to provide a means of income support for this unfortunate generation of the elderly.

Full Benefits Age (FBA) The age at which a Social Security recipient receives full retirement benefits (Primary Insurance Amount).

Early Entitlement Age (EEA)The earliest age at which a Social Security recipient can

receive reduced benefits. The very first beneficiary of Social Security was Ida May Fuller. da May worked for only three years after the establishment of the Social Security system, and paid a total of $24.75 in Social Security taxes. Ida May went on to live for 35 more years, dying at age 100 in 1975. Ove those 35 years, she collected a total of $22,888.92 in Social Security benefits. Quite a return on her $24.75 investment! Ida May is a striking example of the first generation of Social Security beneficiaries who were the big winners under this new social program.

Tests.

1-c

2-a

3-d

4-b

5-c

6-c

7-e

8-a

9-c

10-e

3.1 The family with indifference curves labeled was consuming very little education prior to the education program(When the public education program is introduced, they move into public education system,their consumption of education increases to 4000 and on goods up to 20000. B) family was consuming more than 4000. When the system is introduced family also moves into the public education system. Reduction in spendings on education,increase on consumption.C)is unaffected by introducing the program. (а-сверху,с-снизу)

3.1 The family with indifference curves labeled was consuming very little education prior to the education program(When the public education program is introduced, they move into public education system,their consumption of education increases to 4000 and on goods up to 20000. B) family was consuming more than 4000. When the system is introduced family also moves into the public education system. Reduction in spendings on education,increase on consumption.C)is unaffected by introducing the program. (а-сверху,с-снизу)

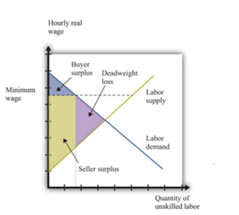

3.2 Suppose the federal government is considering raising the minimum wage to $10 per hour. An economist testifies to Congress that this plan is inefficient and causes deadweight loss.

c)The selection and implementation of a proper wage policy require the government to make tradeoffs between efficiency and equity, because too much emphasis on equity in the wage distribution will undermine the economic growth for not releasing productivity thoroughly.

d)Earned Income Tax Credit (EITC), an income tax policy aimed specifically at low-income

d)Earned Income Tax Credit (EITC), an income tax policy aimed specifically at low-income

wage earners. The EITC subsidizes the wages of low-income earners to accomplish two goals: redistribution of resources to lower-income groups and increases in the amount of labor supplied by these groups.

|

|

|

VARIANT 2

Does asymmetric information necessarily lead to market failure?

Information asymmetry can arise in insurance markets when individuals know more about their underlying level of risk than do insurers. This asymmetry can cause the failure of competitive markets. Are insurance companies destined to fail whenever there is asymmetric information? Not necessarily. First of all, most individuals are fairly risk averse.

Risk-averse individuals so value being insured against bad outcomes that they

are willing to pay more than the actuarially fair premium to buy insurance:

they are willing to pay a risk premium above and beyond the actuarially fair

premium. Even if there is no pooling equilibrium, the insurance company can address

adverse selection by offering separate products at separate prices.332p

Explain the problem with Insurance: Moral Hazard. The Problems with Assessing Workers’ Compensation Injuries. Why is moral hazard a problem? Even if social insurance encourages individuals to, for example, spend more time at home pretending to be injured than being at work, why is that an important cost of social insurance?

When governments intervene in insurance markets, however, the analysis is one step more complicated because of another asymmetric information problem called moral hazard, which is

the adverse behavior that is encouraged by insuring against an adverse event. The existence of moral hazard means that it may not be optimal for the government to provide the full insurance that is demanded by risk-averse consumers. The difficulty of assessing injuries is a problem because it can be quite attractive to qualify for the workers’ compensation program. By trying to insure against an adverse event (true injury), the insurer may encourage individuals to pretend that the adverse event has happened to them when it actually hasn’t. This scenario is a primary example of moral hazard.

|

|

|